Start now

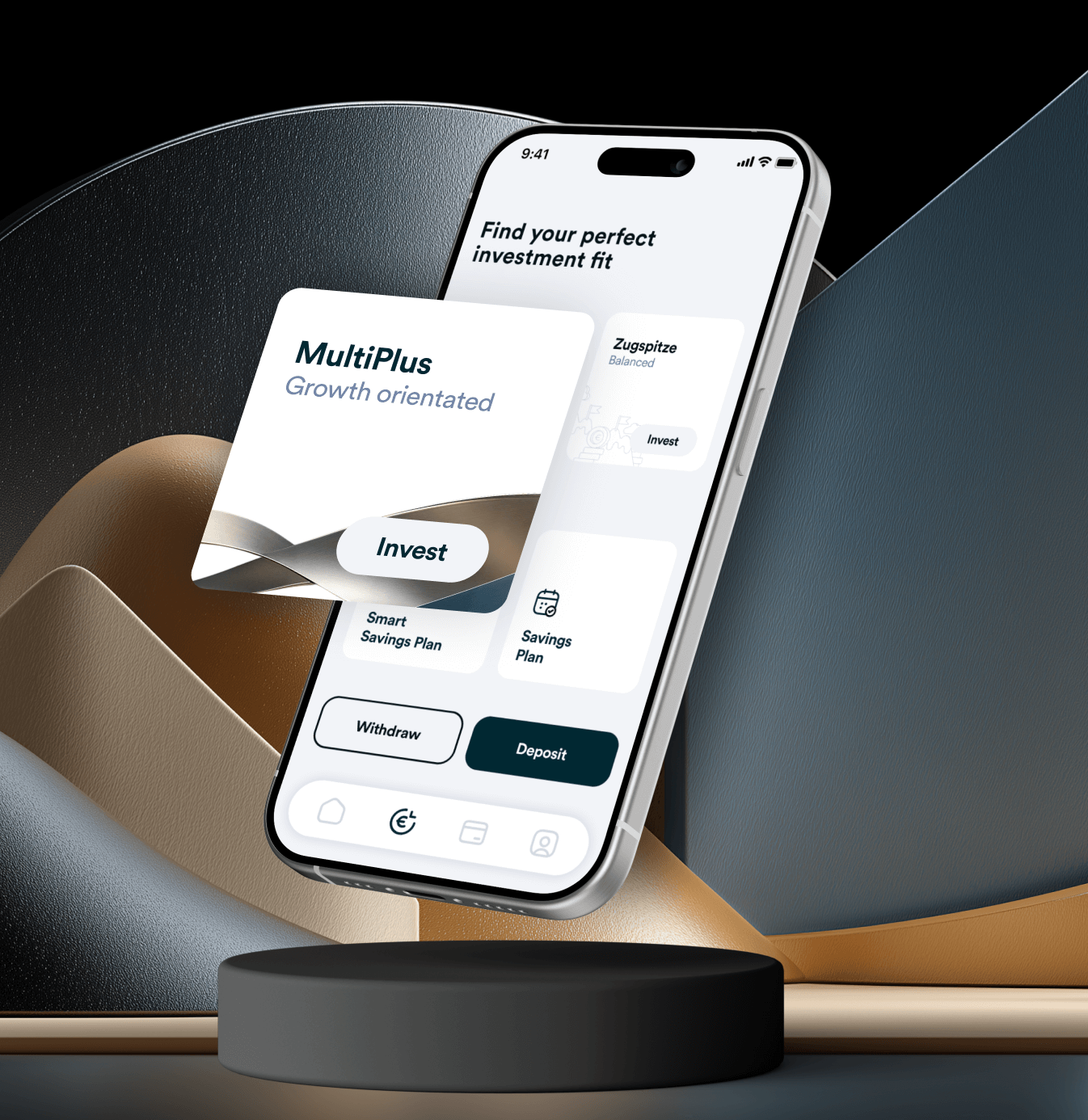

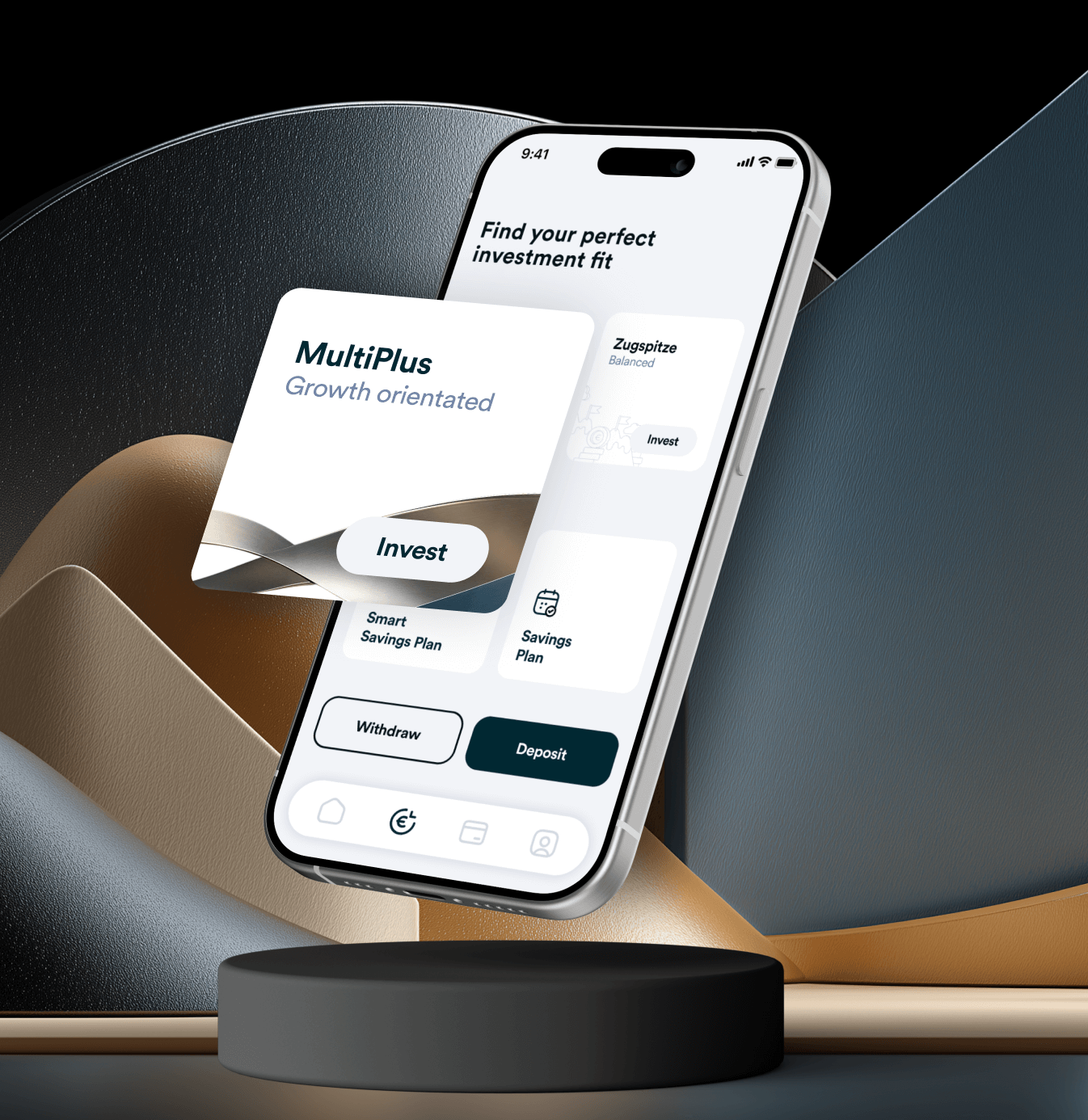

Germany’s first multi-asset portfolio made of active ETFs

Developed with active ETFs from Goldman Sachs Asset Management. For greater return opportunities with optimal risk management.

Start now

MultiPlus – Innovation meets investment

Following the successful launch of AktienPlus as the first active ETF portfolio in Germany, UnitPlus is taking the next step:

MultiPlus is a globally diversified portfolio with 70% equities and 30% bonds, constructed entirely from active ETFs from Goldman Sachs Asset Management.

MultiPlus combines one of the world’s most proven portfolio strategies with an active ETF approach – for investors who want more: more potential. More control. Less effort.

Why MultiPlus?

Attractive

returns

Active ETFs aim to outperform their benchmark after costs, offering above-average potential.

Global

diversification

Investments in stocks and bonds worldwide ensure a stable, well-diversified portfolio.

Focus on

Europe

Around 50% of the allocation goes to European markets – as a counterbalance to the typical US dominance of many standard portfolios.

Cost

Efficient

Professional management and low-cost ETF structures are cleverly combined.

Developed in collaboration with Goldman Sachs Asset Management

With MultiPlus, you invest in an actively managed ETF portfolio backed by decades of expertise from one of the world’s most renowned asset managers – now in a digital, transparent, and flexible product.

We are proud to support UnitPlus in expanding its range of active ETFs. By integrating our actively managed solutions, we believe UnitPlus can continue to deliver on its promise of providing its clients with access to robust investment instruments that combine simplicity with professional quality. This collaboration is a step forward in offering investors greater product diversity and improved portfolio selection options.

David Nolten

Executive Director

Goldman Sachs Asset Management

David Nolten

Executive Director

Goldman Sachs Asset Management

With MultiPlus, we are launching the second active ETF portfolio in Germany that combines institutional expertise with digital progress and optimally implements one of the megatrends on the capital market with active ETFs.

Fabian Mohr

Co-founder of UnitPlus

Fabian Mohr

Co-founder of UnitPlus

MultiPlus can be optimally combined with other investment strategies.

If you want to invest in a professional portfolio with attractive long-term returns and have a longer investment horizon, MultiPlus could be the ideal choice for you. In addition, all other UnitPlus investment strategies are available to you, giving you not only complete flexibility but also diversity.

Secure your next-generation stock portfolio.

Download the app.

Do you have any questions? We have the answers:

How much return can I expect with MultiPlus?

MultiPlus invests 70% in equities and 30% in bonds via active ETFs from Goldman Sachs Asset Management. This mix, also known as a global portfolio, creates an attractive risk/reward ratio. The portfolio’s goal is to generate a return of approximately 8% per year after costs, with lower risk compared to the stock market.

What distinguishes MultiPlus from other portfolios?

MultiPlus is the first professional multi-asset portfolio with active ETFs in Germany. Active ETFs are one of the biggest trends on the capital market and combine the best of both worlds: the advantages of ETFs are combined with slightly active management. The active management of the ETFs is provided by Goldman Sachs Asset Management. MultiPlus is therefore not a conventional ETF portfolio, but rather utilizes active management to exploit global return opportunities and reduce risks. Another notable feature is that around 50% of the portfolio is invested in Europe, meaning it has a significantly higher proportion of European equities than normal portfolios.

Who should invest in MultiPlus?

MultiPlus is suitable for investors who want to build up long-term wealth. The relatively high proportion of equities offers an attractive risk/reward ratio, which may include short-term setbacks.

More information about MultiPlus can be found in our blog article.

Risk notice: All capital market investments carry risks that can result in total loss. Past performance is not a reliable indicator of future results. Goldman Sachs Asset Management assumes no liability for the accuracy, completeness, or timeliness of this article.